What Does a Buy-Sell Agreement Accomplish?

San Diego Corporate and Business Attorneys

What is the buy-sell agreement, and why is this one of the most important corporate documents and business contracts for any San Diego or California LLC or corporation?

3 Most Important Takeaways About a Buy-Sell Agreement

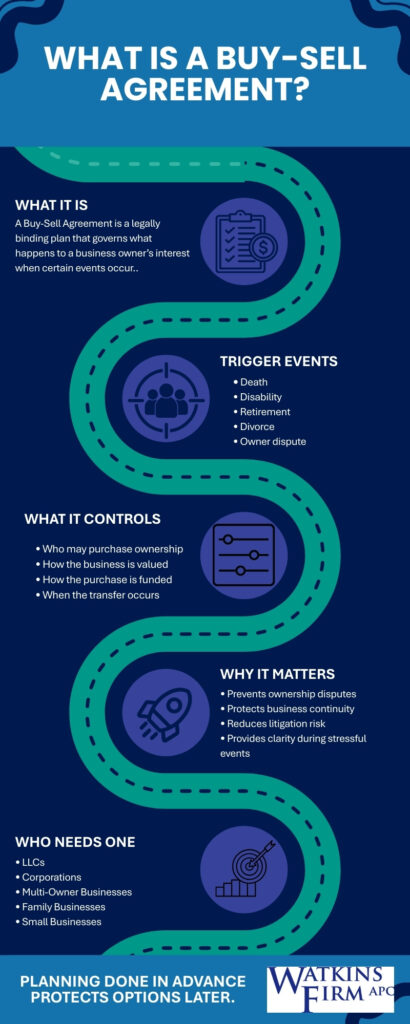

- The Buy-Sell agreement governs the process, the conditions, and the terms for transferring a business ownership interest.

- It establishes, who is required or allowed to purchase an ownership interest, when it may be transferred (triggering events) and how the ownership interest valuation is to be established.

- An effective Buy-Sell agreement provides safeguards to prevent disputes before they arise, and specific guidance to resolve any such dispute.

What Does an Effective Buy-Sell Agreement Do?

The buy-sell agreement establishes, in writing, all of the foreseeable events that might affect the ownership interests of the partnership, business or corporate entity, and what will happen if and when an event or “trigger” occurs. Many business people have not considered the impact that the death or incapacitation of one of the owners would have on the life of the company itself. What happens to the ownership interest of a business when one of the principals goes through a divorce or bankruptcy, or becomes incapacitated for any reason?

The buy-sell agreement establishes, in writing, all of the foreseeable events that might affect the ownership interests of the partnership, business or corporate entity, and what will happen if and when an event or “trigger” occurs. Many business people have not considered the impact that the death or incapacitation of one of the owners would have on the life of the company itself. What happens to the ownership interest of a business when one of the principals goes through a divorce or bankruptcy, or becomes incapacitated for any reason?

Investors and partners buy into a business with the best of intentions. One of the most common issues that arises during the life of a small business is that one of the partners isn’t quite pulling their own weight, or the company has grown past the capacity and skill set of that individual. What happens in that case? How does the business or the remaining owners acquire that ownership share to protect the management and prosperity of the company? What is the value of that interest, and how is that value to be established? Who has the first right to buy the shares, interest or membership of another owner or investor in the company?

These questions are best answered during the process of business formation, or while a business is operating profitably, when all parties are working together in a positive and productive manner. These questions are answered by a contract called the “buy-sell agreement”. It is one of the essential corporate documents of any S corporation or C Corporation, Professional Corporation or Management Services Organization or MSO. It is in addition to, or a component of, the operating agreement of an LLC.

If your company doesn’t have a buy / sell agreement in place we invite you to contact the experienced San Diego business attorneys at the Watkins Firm for a free consultation at 858-535-1511. We will discuss the unique structure of your business and the ownership interests within it. We will help to carefully craft an effective buy-sell agreement that will foster continued growth and prosperity, while providing for the natural events in the lives of your company’s owners that may occur at any time along the way.

Once an Event has Happened the Costs to a Business are Immediately Exponentially Higher

Unfortunately, we’ve seen it hundreds of times: a business is thriving until an unexpected accident, the death of a shareholder or member of an LLC ,or a health incident incapacitates or takes the life of one of the owners. It can even be as simple as an owner’s divorce or a bankruptcy. Now the surviving spouse, ex-spouse or children of your fellow owner (or their estate) have an ownership interest in your business. The resulting legal battle will be quite expensive, consuming the attention and focus of the ownership and leadership of the business, and the resolution might be determined by a total stranger to all parties: a judge.

Unfortunately, we’ve seen it hundreds of times: a business is thriving until an unexpected accident, the death of a shareholder or member of an LLC ,or a health incident incapacitates or takes the life of one of the owners. It can even be as simple as an owner’s divorce or a bankruptcy. Now the surviving spouse, ex-spouse or children of your fellow owner (or their estate) have an ownership interest in your business. The resulting legal battle will be quite expensive, consuming the attention and focus of the ownership and leadership of the business, and the resolution might be determined by a total stranger to all parties: a judge.

It’s not a question of “if”. It’s a matter of “when”. Once a triggering-type event has occurred, and emotions (and external greed) are in play, it can be quite challenging to reach an agreement or resolve the question of who has the right to acquire the ownership interest in question, or at what price. The buy-sell agreement prevents disputes and “what-ifs” before they ever happen. It should clearly establish the process for “who” has the right to purchase an ownership interest (as well as the order of who has first rights, second, etc.). It saves your company huge sums of money while protecting you and all of the owners of the business, as well as the business itself. An effective buy-sell agreement clearly defines how the business itself, or the remaining ownership interests can purchase, buy out or economically compensate the partner or his beneficiaries when a triggering event occurs. A well crafted buy-sell agreement will establish the process for “valuation” of the ownership interest, and the process for acquiring or financing the buy-out of that interest.

Pro-Tip: “If you have a company, and let’s say there’s three or five people that are members in this LLC, life happens, unfortunately, people die, they become incapacitated, they get divorced, they file personal bankruptcy. So why is it important to address what happens in those events upfront in an operating agreement in this case?

Pro-Tip: “If you have a company, and let’s say there’s three or five people that are members in this LLC, life happens, unfortunately, people die, they become incapacitated, they get divorced, they file personal bankruptcy. So why is it important to address what happens in those events upfront in an operating agreement in this case?

The reason is actually quite simple: Because it doesn’t cost that much money and we already have many boilerplate buy-sell agreements in our proprietary library of contracts. We find one that fits your unique situation, and cost-efficiently customize it to your unique requirements. And not only do we automatically do it for you, we go through it and we go through all of the areas that are important, or that might happen, so you can think about and to know which choices in the buy-sell agreement are best for you and your company. And so when a triggering event happens, which you never think it could happen, you’ll remember that, ‘oh yeah, we do have a document for what happens to Uncle Joe can’t participate anymore.’

It’s a long document, but it’s in there, it’s there for you. It’s a framework and it gives you guidance on what steps you should take. How are we going to value that person’s interest? Who gets the first shot at buying them out? A lot of what ifs. And you can’t account for every possible what if on the planet, but there are 95% of the what ifs you may come across in your life that can be covered by your standard agreement.

And if a business owner fails to address these issues them up front, and now they are three years down the road and they’re making money and they’ve got 5 owners, and they are rocking at it and boom, something happens. What’s the cost? What’s the disruption? What happens when the wheels come off if you don’t address it up front?

After almost 40 years, I can tell you this: If there’s a lot of money, there’s a lot of fights. And what do they say in the military? … failure to plan is a plan to fail. That get’s incredibly costly when the owners of a business are fighting over an issue like this.

This is why we talk to you about it up front, and as we work with you throughout the life of your business. We talk through these things with you. We improve your knowledge of how this works. Later, when you’re having everyday discussions with co-owners you do it with less stress and you’re prepared for a lot more than you would be had you just tried to form it yourself,

And when businesses are starting up, there’s an energy to that. There’s an excitement. We’re all pulling the same direction. Those conversations are a lot easier at that point than they are three or five years down the road. It really makes you feel good when you know you planned for a lot of things. Now you can focus on making money and it makes your company worth more money and as you go down the road.

People don’t fight if there’s an agreement in place. It’s really true. The vast majority of cases we have where they fight, and there’s always money, is when there was no agreement defining what happens with this and that. Look, business owners and investors aren’t evil. They just, they just convince themselves they’re being ripped off or they convince themselves they have more rights because there’s no shareholder agreement they can read. There’s no agreement in writing that says, definitively, if this happens, then these are the rules. If there’s no rules, then people get in their own heads and can convince themselves of a lot of things.

And they then they fight. And they don’t just fight in court. They take actions, they do things. And instead of an orderly, sound plan … chaos. Expensive chaos.” – Dan Watkins, Founding Partner

Contact Experienced San Diego Business Buy-Sell Agreement Lawyers

Facing these challenges in the midst of a crisis is emotionally challenging and potentially financially devastating. Developing an effective buy/sell agreement up front, during business formation or early in the life of the company is exponentially less expensive, and ensures that all of the hard work, time and money you invest in your new business will be protected. It protects the value and stability of your company, relationships within your ownership team, and provides for the families and loved ones of each shareholder, partner, investor, or member.

Facing these challenges in the midst of a crisis is emotionally challenging and potentially financially devastating. Developing an effective buy/sell agreement up front, during business formation or early in the life of the company is exponentially less expensive, and ensures that all of the hard work, time and money you invest in your new business will be protected. It protects the value and stability of your company, relationships within your ownership team, and provides for the families and loved ones of each shareholder, partner, investor, or member.

Does your business entity need a Buy-Sell Agreement? We invite you to review our podcast Episode 34 – Business Formation as well as the strong recommendations of our clients and contact the Watkins Firm or call 858-535-1511 for a complimentary consultation today.

Call 858-535-1511 for a Free Consultation

As a business, we understand the importance of protecting your business throughout its lifetime, from formation to eventual sale or dissolution. We get to know your business and understand your goals and objectives so that we can provide the most effective combination of advice and services to help you reach them. We have worked with literally thousands of local and regional businesses and can help you to avoid business disputes and pitfalls, and prosperously grow your business. Contact us online or call 858-535-1511 to discuss your case with a knowledgeable business law attorney in San Diego, California.

Contact a Business Lawyer Or Corporate Attorney Today

To set up a free, no-obligation consultation with one of our knowledgeable San Diego business lawyers, call us at 858-535-1511 or contact us online.